IBL News | New York

The New York State Division of Consumer Protection issued a scam warning to all post-secondary students as they head back to campus and have to make many decisions and deal with new situations. New York State is home to 300 higher Ed institutions.

“Whether living away from home for the first time, navigating financial aid, or building credit, students have ample opportunities to get scammed,” stated the NYS Division of Consumer Protection (DCP).

In this regard, the Secretary of State, Robert J. Rodriguez, said that “the best way for college students to avoid textbook, scholarship or rental scams is to be informed.”

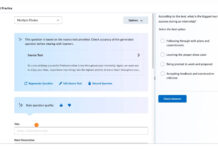

These are the main tips to prevent scams, according to the authorities:

- Fake Scholarships, Grants, or Loans. Don’t believe anyone who offers guarantees or pre-approvals for loans or grants. The required paperwork to apply for financial aid is the FAFSA form and it’s free.

- Unpaid Tuition Scam. Ignore calls claiming that you’ll be dropped from all classes unless you pay tuition immediately over the phone. Always call the school bursar’s office directly to verify your account status. Schools generally send an invoice to alert students of account status.

- Fake Employment or Internship Offers. Never pay an upfront fee to move forward in an interview process or provide too much personal information, such as your SSN, during the application or interview process.

- Buying Books Online. Scam artists set up fake websites and offer great deals on expensive textbooks only to never deliver the textbooks leaving the student out of cash and with no textbook. Learn how to identify fake website listings for textbooks and supplies. Before you buy, do your research, and confirm it’s a reputable source. Pay attention to contact information and return policies. Legitimate sites provide a physical address and working phone number in the contact section.

- Roommate/Rental Scam. Scammers pose as an individual selling or renting a property or as someone on behalf of a property owner. Potential renters are then solicited for money in exchange for promises that the homes will be shown to them or rented to them upon completion of payment. The scam is realized when there is no home for sale, or the property is already occupied.

- Credit Cards. If applying for a credit card for the first time, do your own research. Students are often targeted with misleading credit card offers that could be a veiled attempt at identity theft or may charge exorbitant annual fees and interest rates.

- Understand the consequences of identity theft. Higher education students are at great risk of identity theft, but you can minimize these risks by protecting yourself and keeping your information private. It’s important that you understand the consequences of identity theft. Criminals can use your personal information to build a fake identity and open new accounts or loans under your name. Restoring credit and correcting false information can be a costly and lengthy process so it’s best to prevent it before it happens.

- Keep all personal identifiable information private. Whether it’s in a dorm room, online, or in any social situation, keep all information and documents containing personal information private and securely guarded. Personally identifiable information is information that, when used alone or with other relevant data, can identify a person.

- Remember to always keep a close hold on your social security number (SSN) and ask why it’s needed before deciding to share it. Oftentimes organizations include the SSN request as a formality, and it may not be mandatory. Ask if you can use a different kind of identifier.

- Personal documents, checkbooks, credit card statements and other personal papers should be always locked securely.

- When searching for and applying for student loans or other applications for financial aid, never share personal information via the phone or internet unless you have initiated contact.

- Shred pre-approved credit card offers and bills before disposing of them.

- Practice Online Safety.

- Social media is a great place to connect with friends or catch up with the latest viral trend but remember to save some secrets for yourself. Social media posts often reveal sensitive information unintentionally. Cybercriminals look for content that can reveal answers to security questions used to reset passwords, making accounts vulnerable to identity theft.

- Avoid downloading free music, games, or apps. Free downloads come with a price – identity theft. Often the free apps, music, and games are tainted with keystroke logging malware.

- Avoid using public WIFI/computer to shop online or pay bills.

- Monitor privacy settings on all online accounts.

- Before you get rid of your old laptop or smartphone, protect your data so it doesn’t end up in the hands of an identity thief. For tips on how to protect your data before getting rid of your devices, please see information from this Federal Trade Commission article.