IBL News | New York

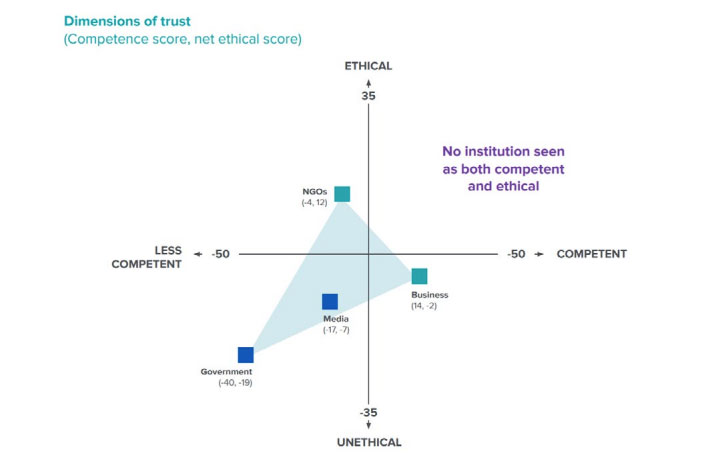

An insightful, updated, free PDF report with predictions for 2022 on crypto is getting significant traction among millennials and Gen X investors—a techno-political movement who distrust the system and see “no institution both competent and ethical.”

The research, titled “Crypto Theses for 2022”, works as a 101 course that includes key trends, people, companies, and projects to watch across the crypto industry landscape.

It started as a tweet thread with links four years ago.

The author, Ryan Selkis, Founder and CEO at Messari.io, a research and data start-up, structured his research across 165 pages and ten chapters:

1. Top 10 Narratives & Investment Themes

2. 10 People to Watch

3. Top 10 Thoughts on Bitcoin

4. American Crypto Policy

5. Market Infrastructure

6. NFTs & Web 3 Plumbing

7. DeFi 2.0

8. ETH, Layers, and Bridges

9. The DAO of DAOs

10. BONUS: Whatever I Want

The report is built upon the belief that “decentralized technologies with embedded financial incentives offer a compelling, often lucrative, alternative to our decaying legacy institutions.”

The author predicts that “Web3” — defined as the internet owned by the builders and users, orchestrated with tokens — is an unstoppable force in the long term.

Other claims of Ryan Selkis are the following:

- “The user-owned economy will outperform the monopolist-owned economy in the long-term.”

- “We’re going from an internet built on rented land with monopoly overlords, to an infinite frontier of new possibilities. On the frontier, crypto presents a credible revolution to all monopolies, which is why its inevitability scares the incumbents.”

- “I have 99% conviction that crypto will be an order of magnitude larger by 2030 because the user economics here is an order of magnitude more attractive. We’re on the brink of a total transformation of the global economy. One that’s bigger than mobile, and maybe even the internet itself.”

- “We live in a period of social upheaval, where young people are keen to invest in technologies that disrupt (and potentially bankrupt) older generations’ preferred institutions while pushing investments that benefit themselves at the expense of the old guard.”

- “The best part about being young and broke, he says, is that you have little to lose.”

- “We believe that crypto will democratize access to information, break down data silos, and ultimately give everyone the tools to build wealth.”

- “Crypto will eliminate deplatforming risks.”

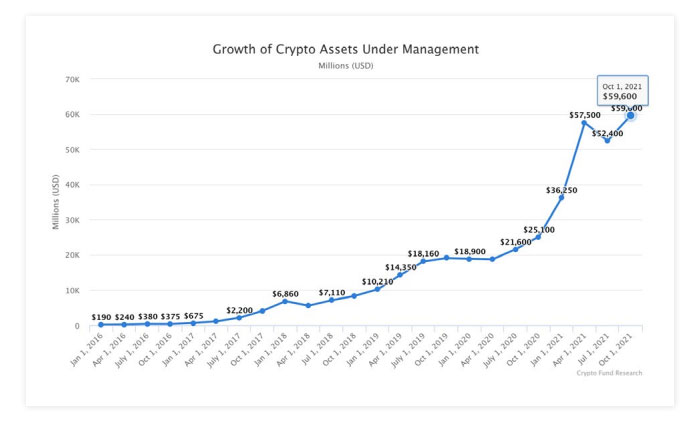

This year, the crypto industry has received record capital raises, and some of the funds, like Multicoin, are among the best-performing investment firms of all time. Crypto’s $3 trillion of liquid value creation in 10 years now rivals that of all other venture-backed startups combined, according to Messari.io.

Firms like Polychain, Paradigm, a16z, Multicoin, 3AC, and others are each managing billions of dollars (in some cases, $10 billion+) or more, and investing $25mm a clip in their medium-sized deals.

Hedge funds plan to deploy 7% of their assets into crypto within 5 years.

En Español

En Español